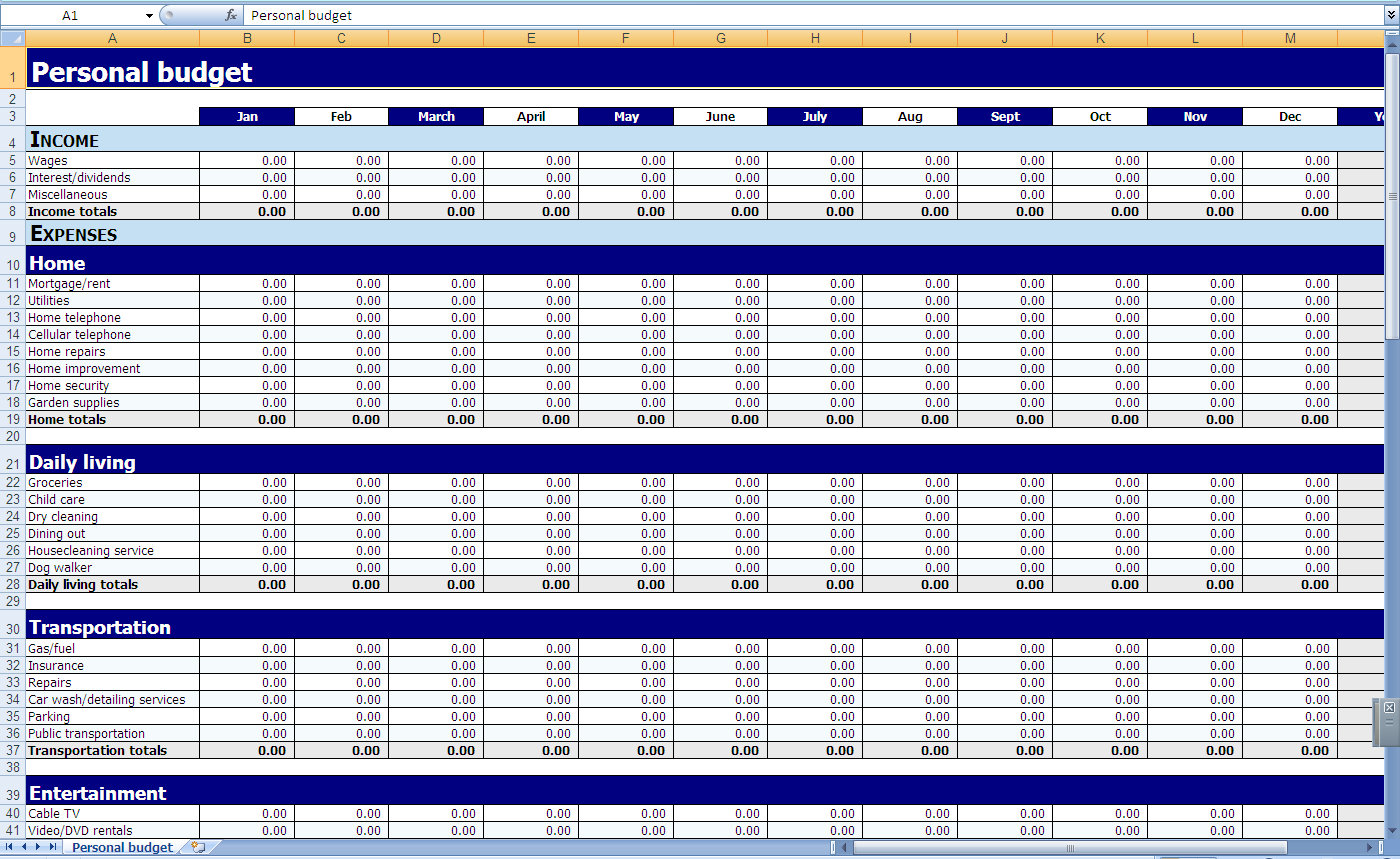

Here is where you will want to add expenses such as your car payment, car insurance, gas, oil changes, etc. You may even have expenses like lawn care, garbage pickup, home furnishings, home improvements.

In the housing expenses category, you will want to add expenses like your house payments, rent, electric bill, gas bill, water, sewer, insurance payment, cable & internet, Netflix, etc. You can also add income from side hustles here. Here you will want to include income that you make from your day job for yourself or anyone you share expenses with. When categorizing your monthly expenses, here are some examples of expenses you can add to each category. These categories within our monthly budget template will help you track all of your major expenses. Our monthly budget template, from our Budget Binder, includes places for you to budget for your: We earn a commission if you click this link and make a purchase at no additional cost to you.Īre you wondering where all of your money is going each month? Or do you know that you need to use a budget, but you just haven’t found the perfect one for you yet? Look no further, because our monthly budget template is exactly what you need to help you get in control of your finances. A budget calendar will help you stick to a plan for the future, review your progress, and remain flexible enough to adjust your strategy as you learn from your mistakes.Ĭoncentrate on growing and improving in your financial journey, not achieving perfection.This Post May Contain Affiliate Links. Whether you’re getting a head start on your financial goals or playing catch-up to conquer debt, planning ahead and staying organized are the two major keys to achieving your objectives. You can also add additional calendar pages dedicated to helping you reassess your goals every few months. Leave space in the margins to add your monthly budget categories and savings goals, as well as any other information that’s important to you, like debt balances or current credit score. Add dates like tax deadlines and infrequent special events like Christmas, weddings, or birthdays that might require additional spending. Mark all automatic transfers to savings accounts and contributions to retirement accounts and other benefit programs. Add the due dates and amounts for all of your bills, such as credit cards, utilities, and loan payments. If your income is variable, decide on regular days to record what you’ve earned and mark those instead.

Track your paydays and amounts each month. While your budget calendar has room to record the basic budget categories, you may want to add a purpose-built budget tracker if you’d like to break your budget out into smaller categories or if you have a longer list of monthly spending items.Įveryone’s budget calendars vary a bit according to their needs, but there are a few key elements all budget calendars should have: If you’re paying off debts (like student loans, credit card debt, or medical bills) this year, you should add a tracker designed specifically to help pay off debt. Your calendar isn’t meant to track small, day-to-day expenses like a cup of coffee, so you should also use a spreadsheet or tracker to stay mindful of how minor spending can add up. To maximize the power of your calendar and set yourself up for a successful year, you should add a few other tools to the mix: While a budget calendar is a powerful tool, it’s just one weapon in your financial arsenal. Plotting key dates and recording your cash flows will help you anticipate and plan for financial events and emergencies, preventing you from being caught off-guard and having to deplete savings or go into debt.

#Monthly budget calendar template free download

We’ve created a printable budget calendar designed for organizing your money in 2023 - download and print it to get started! How a Budget Calendar Can Help You Achieve Financial GoalsĪ budget calendar can help you with whatever you hope to accomplish financially, whether it’s paying off existing debts or building up savings to invest in your future. You can choose to add a budget calendar to your existing paper or digital calendar, or you can create a brand-new calendar that’s just for tracking your finances. And there’s no better way to do so than by creating a budget calendar to track your income, expenses, and financial goals throughout the year. The new year is the perfect time to recommit to getting your finances organized.

0 kommentar(er)

0 kommentar(er)